Every day, banks handle millions of customer support requests—from simple account questions to complex disputes over transactions. If you work in banking, you know how crucial it is to manage these interactions efficiently while keeping sensitive financial data secure. That’s where robust help desk systems come in.

Support teams in financial institutions face a tricky balance: they need to verify customer identities, protect confidential information, and maintain accurate records to meet compliance standards, all while delivering fast, reliable service. The help desk system is the backbone that keeps these operations running smoothly. So, how do modern help desks transform banking customer service? Let’s dive into the key features that make it all possible.

What is the role of Help Desks in Banking?

In banking, a help desk isn’t just about answering customer queries. It’s a full-fledged support management system that tracks, organizes, and resolves inquiries while keeping strict security protocols in place. Essentially, it centralizes all customer communications, ensuring that everything from compliance to data security is taken care of.

These help desks manage both external (customer) and internal (employee) support. And the challenge? Balancing security with accessibility—making sure customers get the help they need without compromising sensitive financial information.

External Support Management

Banks deal with a wide variety of customer-facing support, each with its own unique requirements:

- Account queries – Verifying identity before discussing account details.

- Online banking issues – Helping customers navigate digital platforms.

- Card services – Handling lost cards and resolving transaction disputes.

- Fund transfers – Ensuring secure transfers while verifying customer details.

- Mobile banking – Addressing app-related issues and managing security features.

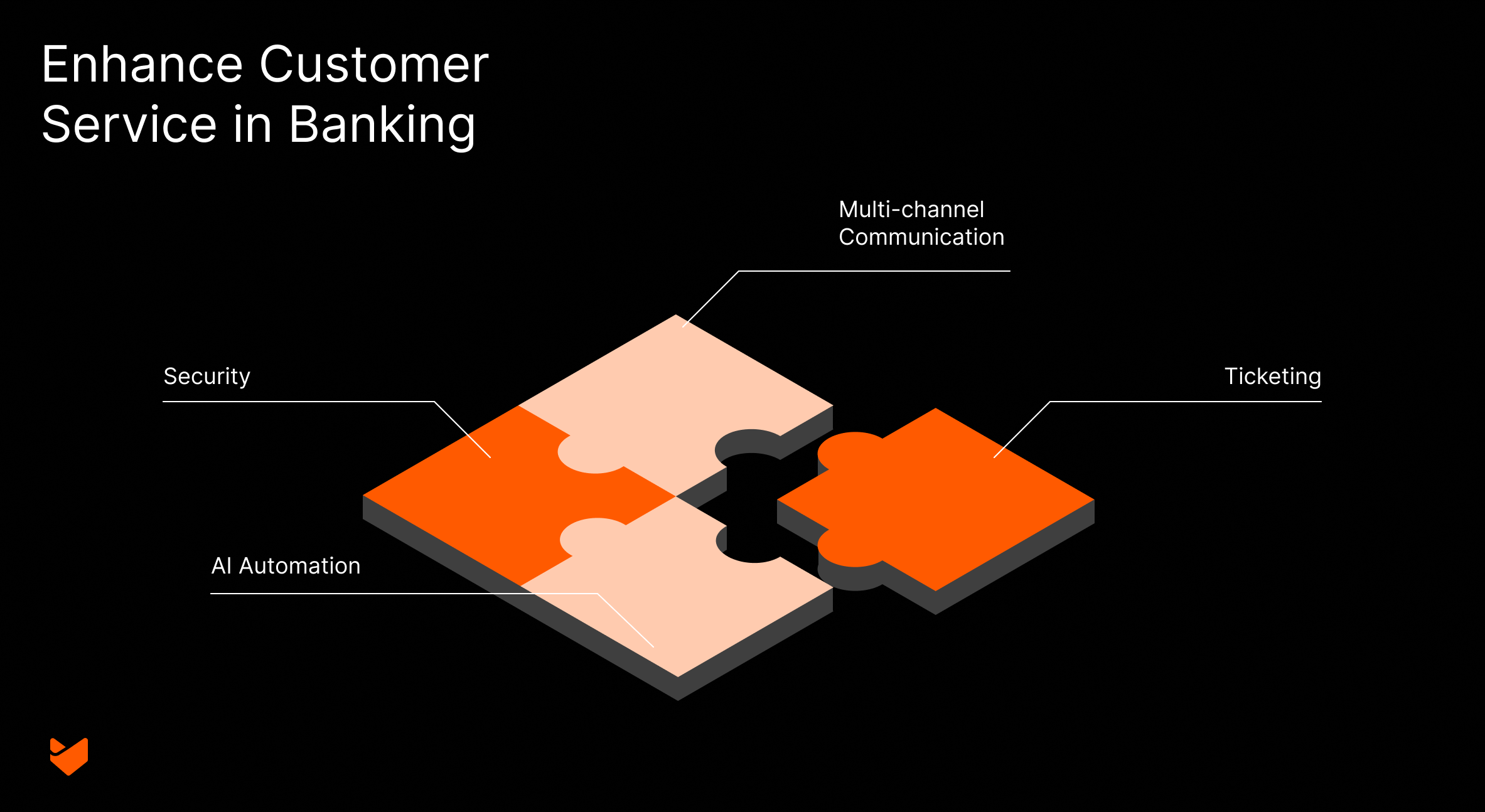

Core Help Desk Features for Banking

What really sets a banking help desk apart are its core features. These are the tools that help support teams handle banking-specific challenges efficiently and securely:

1. Advanced Ticketing System

Think of the ticketing system as the central hub of your support operations. It tracks every interaction and keeps detailed records for compliance purposes. Some key benefits include:

- Automatically capturing customer information for context.

- Smart categorization and routing to the right departments.

- Priority routing for urgent issues, like fraud reports.

- Tracking SLAs (service-level agreements) to ensure timely responses.

- Keeping a detailed history for audits or training.

2. Multi-Channel Communication Hub

Today’s customers want options—whether it’s email, phone, live chat, or even social media. A good Omnichannel help desk makes sure your team can manage all these channels securely and efficiently:

- Encrypting sensitive data in emails.

- Logging and recording phone calls for quality assurance.

- Offering secure self-service portals.

- Using identity verification protocols in live chat.

- Monitoring social media without compromising customer privacy.

3. Robust Security Framework

In banking, security isn’t an option—it’s essential. A modern help desk must comply with financial regulations while still providing fast, efficient support. Here’s how:

- End-to-end encryption for all customer communications.

- Two-factor authentication for agent access.

- Role-based access to control who sees what.

- Session management to automatically log out inactive users.

- IP restrictions to secure access to the help desk.

Streamlining Support Operations

Efficient support operations require careful orchestration of various automated processes. Help desk systems streamline these operations while maintaining security and accuracy.

Workflow Automation

Automation reduces manual effort while ensuring consistent service delivery. Banking help desks leverage automation to handle routine tasks and maintain service standards.

Ticket Assignment and Routing

The automated assignment system ensures efficient distribution of work while maintaining security protocols. This system considers multiple factors when routing tickets.

- Automated systems analyze incoming requests and assign them to qualified agents based on expertise.

- Load balancing algorithms distribute work evenly across available support teams.

- Skill-based routing matches complex queries with agents who have appropriate clearance levels.

- Customer segment analysis ensures premium clients receive prioritized service handling.

SLA Management

Service Level Agreements in banking require strict monitoring and enforcement. The help desk system automates this crucial aspect of support management.

- Response time monitoring systems track every ticket against established service standards.

- Escalation workflows automatically notify supervisors when tickets risk missing deadlines.

- Priority adjustments occur automatically based on customer status and issue urgency.

- Real-time monitoring systems generate alerts for potential service level breaches.

Task Automation

Routine tasks consume valuable agent time that could be better spent handling complex issues. Automation helps streamline these necessary but time-consuming activities.

- Status updates occur automatically based on predefined triggers and conditions.

- Follow-up reminders ensure no customer inquiry goes unanswered beyond set timeframes.

- Bulk actions help manage multiple related tickets efficiently and consistently.

- Automated categorization ensures proper tracking and reporting of support issues.

Knowledge Management System

An effective knowledge base serves as both a training tool and a resource for quick issue resolution. The system must maintain current information while ensuring easy access.

Customer-Facing Resources

The public knowledge base helps customers find answers to common questions while reducing support volume.

- Banking guides provide step-by-step instructions for common banking procedures.

- Frequently Asked Questions cover routine inquiries about banking services and policies.

- Tutorial videos demonstrate proper use of online banking features and security protocols.

- Troubleshooting guides help customers resolve common technical issues independently.

Agent Resources

Internal knowledge resources help agents provide accurate and consistent support.

- Process documentation guides agents through complex banking procedures.

- Product information remains updated with current banking service features and limitations.

- Compliance guidelines ensure agents follow proper security and regulatory protocols.

- Internal troubleshooting procedures standardize problem resolution approaches.

Performance Monitoring and Analytics

Performance monitoring in banking support requires careful attention to multiple metrics. Help desk analytics provide insights that drive service improvements while maintaining security and compliance standards.

Key Performance Metrics

Banking help desks must track various metrics to ensure service quality and operational efficiency. These measurements help identify areas for improvement and validate the effectiveness of support processes.

Response Time Metrics

The speed of response often directly impacts customer satisfaction in banking support. These metrics help maintain optimal service levels.

- First response time measurements track how quickly customers receive initial acknowledgment of their inquiries.

- Resolution time tracking monitors the total duration from ticket creation to final resolution.

- SLA compliance rates indicate how well the support team meets established service standards.

- Category-specific timing analysis reveals which banking issues require the most handling time.

Quality Indicators

Quality measurements ensure that speed doesn’t compromise service excellence. These indicators help maintain high standards of customer support.

- First contact resolution tracking shows how often issues are resolved in the initial interaction.

- Customer satisfaction surveys provide direct feedback about service quality and agent performance.

- Quality audit scores reflect adherence to banking procedures and communication standards.

- Agent performance metrics indicate individual and team effectiveness in handling banking queries.

AI and Automation Capabilities

Artificial Intelligence transforms banking support by enhancing efficiency while maintaining accuracy. Modern help desk systems integrate AI capabilities to improve service delivery and reduce response times.

Smart Ticket Management

AI-powered ticket management streamlines support operations while ensuring proper handling of each inquiry.

- Natural language processing systems automatically categorize incoming customer inquiries.

- Machine learning algorithms determine ticket priority based on content analysis.

- AI routing systems direct tickets to the most qualified available agents.

- Pattern recognition identifies duplicate tickets to prevent redundant responses.

Knowledge Assistance

AI enhances knowledge management by making relevant information readily available to agents and customers.

- Smart suggestion systems recommend relevant articles based on ticket content.

- Response recommendations help agents maintain consistency in similar situations.

- Historical ticket analysis helps identify solutions for complex problems.

- Trend analysis highlights common issues that require knowledge base updates.

Predictive Analytics

Predictive capabilities help banks prepare for future support needs while optimizing resource allocation.

- Volume prediction algorithms forecast upcoming support demands.

- Resource planning tools optimize agent scheduling based on predicted needs.

- Trend analysis identifies patterns in support issues before they become problems.

- Performance forecasting helps maintain service levels during peak periods.

Best Practices for Banking Help Desks

Implementing a help desk in banking requires following a few best practices to keep everything running smoothly:

SLA Strategy Implementation

Your Service Level Agreements (SLAs) need to reflect customer needs and business goals. Prioritize issues based on customer segments, transaction values, and communication channels.

Security Protocol Management

Regular audits, access reviews, and strict data handling procedures are essential to maintaining the security of your help desk system

Conclusion

Help desk systems serve as the backbone of modern banking customer service. They provide essential tools for managing complex customer interactions while maintaining the highest security standards. Success in banking support requires careful balance between efficiency and security, automated processes and human touch, speed and accuracy.

The ideal banking help desk solution combines robust security features with efficient support tools. It should offer:

- Enterprise-grade security protocols that meet banking standards

- Comprehensive ticket management capabilities

- Multi-channel support options

- Advanced automation features

- Customizable knowledge management

- Detailed analytics and reporting

- AI-enhanced support capabilities

When evaluating help desk solutions for banking, consider both current needs and future scalability. The right system will grow with your institution while maintaining consistent service quality and security standards.

HappyFox offers a comprehensive help desk solution designed for the unique needs of financial institutions. Our platform combines robust security features with efficient support tools, helping banks deliver exceptional customer service while maintaining strict compliance standards. Contact us to learn how our solution can transform your banking support operations.